Hong Kong 50 Index approaching important bearish key level

Hong Kong 50 Index is approaching a support line at 20174.9199. If it hits the support line, it may break through this level to continue the bearish trend, or it may turn around back to current levels.

FTSE China A50 Index has broken through support

FTSE China A50 Index has broken through a support line of a Rising Wedge chart pattern. If this breakout holds true, we may see the price of FTSE China A50 Index testing 13585.3527 within the next 5 hours. But don’t be so quick to trade, it has tested this line in the past, so you […]

Will Hong Kong 50 Index have enough momentum to break support?

Hong Kong 50 Index is moving towards a support line. Because we have seen it retrace from this line before, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 14 days and may test it again within the […]

Australia 200 Index approaching resistance of a Rising Wedge

Australia 200 Index is trapped in a Rising Wedge formation, implying that a breakout is Imminent. This is a great trade-setup for both trend and swing traders. It is now approaching a support line that has been tested in the past. Divergence opportunists may be very optimistic about a possible breakout and this may be […]

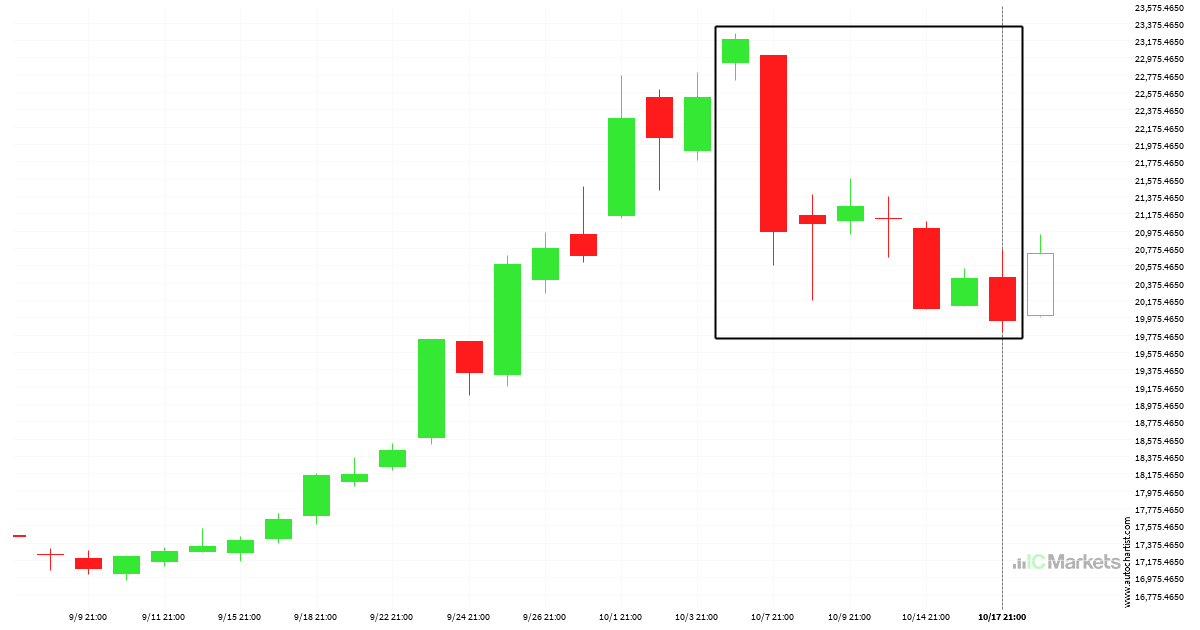

Will Hong Kong 50 Index bounce after a massive drop?

Hong Kong 50 Index has experienced an extremely big movement in last 11 days. It may continue the trend, but this would make the move unprecedented in the recent past.

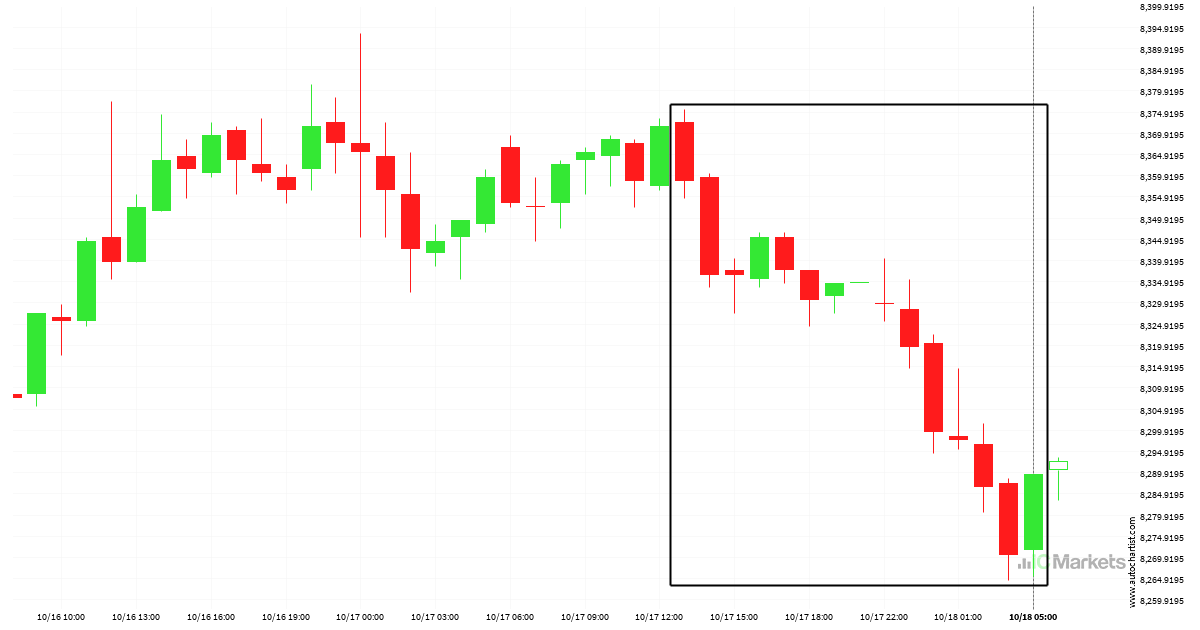

Huge movement on Australia 200 Index, did you miss it?

Australia 200 Index dropped sharply for 16 hours – which is an excessively big movement for this instrument; exceeding the 98% of past price moves. Even if this move is a sign of a new trend in Australia 200 Index there is a chance that we will witness a correction, no matter how brief.

A possible start of a bearish trend on Hong Kong 50 Index

Hong Kong 50 Index has broken through a support line of a Descending Triangle and suggests a possible movement to 19237.2897 within the next 2 days. It has tested this line in the past, so one should probably wait for a confirmation of this breakout before taking action. If the breakout doesn’t confirm, we could […]

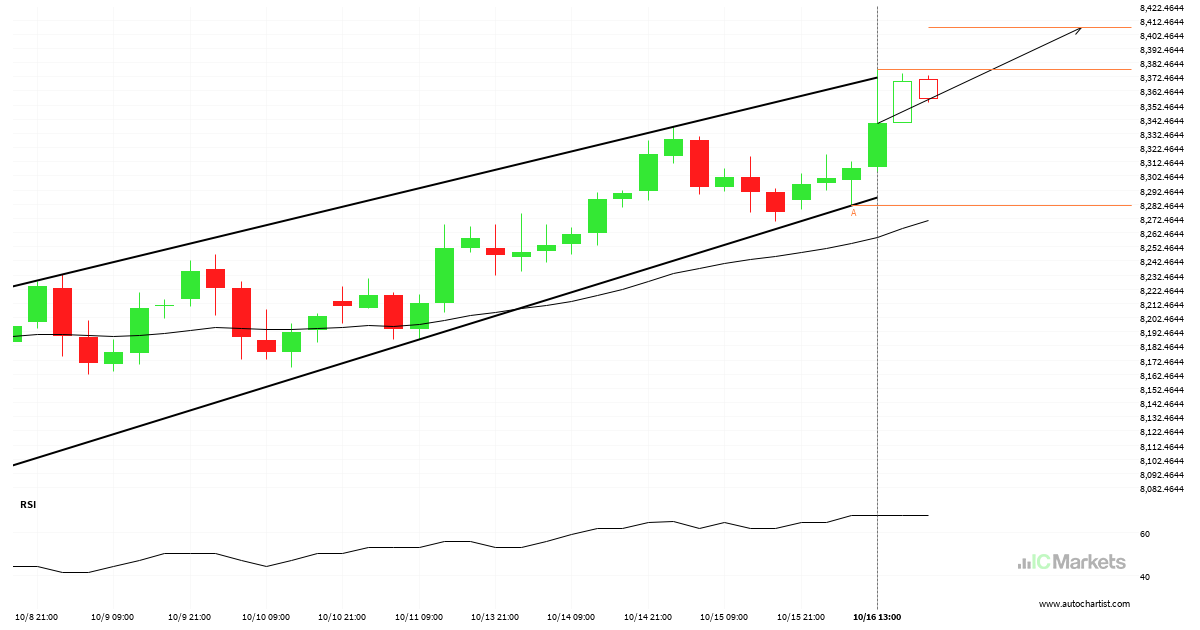

Australia 200 Index – getting close to resistance of a Channel Up

The movement of Australia 200 Index towards the resistance line of a Channel Up is yet another test of the line it reached numerous times in the past. This line test could happen in the next 2 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound […]

FTSE China A50 Index trade outlook at 2024-10-15T07:00:00.000Z until 2024-10-15T07:00:00.000Z

FTSE China A50 Index moved through the support line of a Pennant at 13510.96 on the 4 hour chart. This line has been tested a number of times in the past and this breakout could mean an upcoming change from the current trend. It may continue in its current direction toward 13147.5509.

Hong Kong 50 Index – getting close to psychological price line

The movement of Hong Kong 50 Index towards 20174.9199 price line is yet another test of the line it reached numerous times in the past. We could expect this test to happen in the next 2 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound back […]